What we do

In just over 10 years we have become the world’s largest cotton sustainability programme. Our mission: to help cotton communities survive and thrive, while protecting and restoring the environment. We recognise the size of the challenge. The environment is in danger, climate change at a tipping point, and the majority of cotton farmers and farmworkers are in some of the world’s poorest, worst affected countries. The global pandemic has compounded the difficulties.

We are meeting the challenge head on. Along with our extensive network of partners and members, we are making cotton farming a more climate-resilient, environmentally friendly and responsible business. Already nearly a quarter of the world’s cotton is produced under the Better Cotton Standard, a system and set of principles designed to deliver just that. Our holistic, farm-level approach to improving cotton production is the key.

We champion sustainability

We continue to train an ever-growing workforce in more sustainable farming practices. Not only farmers but farm workers and all those connected with the growing of cotton. Over the last decade this adds up to a community of nearly 4 million that we call ‘Farmer+’. The better they all understand the soil, water and climate challenges they face, the more they and their communities stand to benefit environmentally, socially and economically. At the other end of the spectrum, for those farming on a high-tech, industrial scale, using more and more sustainable methods delivers profitability to match.

We promote collaboration

We already have a network of almost 70 partners working with farmers on-the-ground. We work with donors, civil society organisations and governments and other sustainable cotton initiatives too.

We drive continuous improvement

With the assistance of these partners, we continue to refine our understanding of the diverse needs of farming communities to maximise the impact of our programmes at field level and promote better farming. At an organisational level we pursue improvement equally keenly. We review our approach continuously to make sure it is fit for purpose; we innovate and adapt training and assurance activities, and we update and promote implementation of the Better Cotton Standard around the world.

We pursue growth

Growth is key to our aim of making Better Cotton a global, mainstream, sustainable commodity. It relies on it being produced at scale, so by 2030 we want to have doubled Better Cotton production. In turn this requires that we share best practice, latest data, and access to finance to drive demand and uptake in current and new markets.

We must make an impact

We have a 10-year strategy mapped out to deliver real, measurable change, in line with the 2030 Sustainable Development Goals. Improving the environment is the precursor to regenerative agriculture. Increasing yields and market access while at the same time promoting decent work, reducing inequalities, and driving gender empowerment is designed to have a lasting impact on lives and livelihoods

.

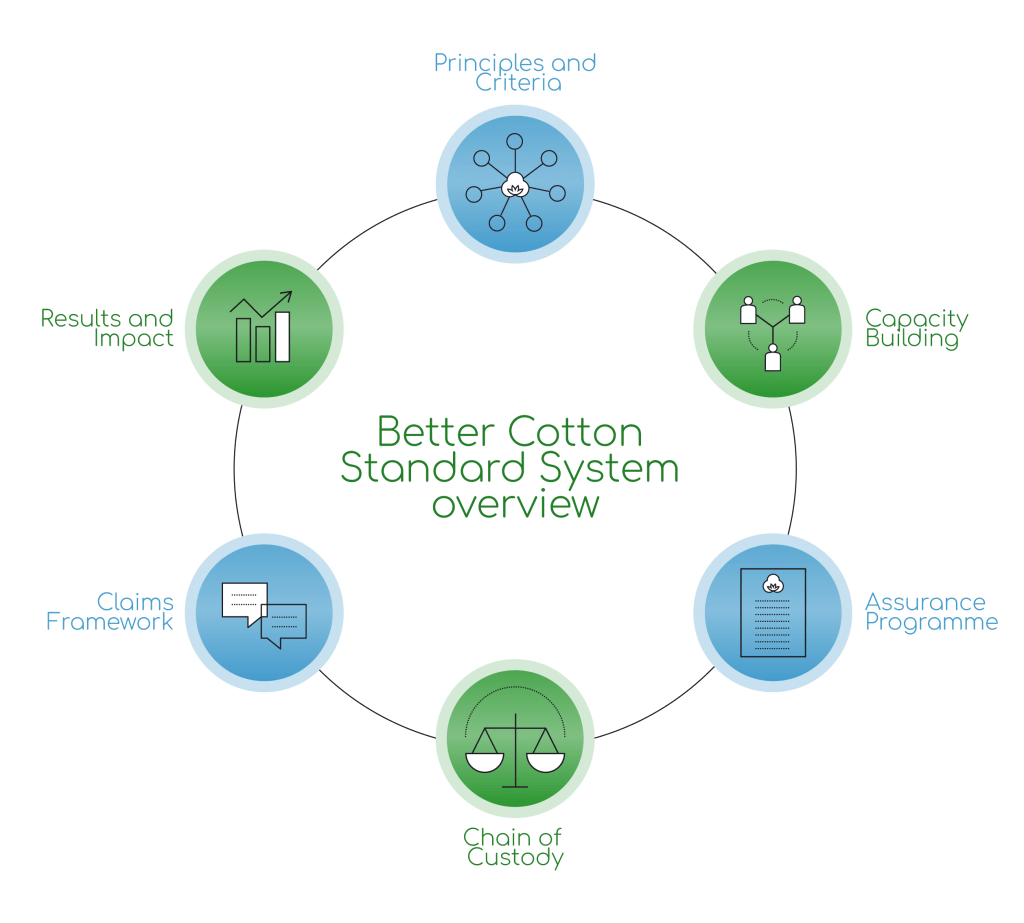

The Better Cotton Standard System

The Better Cotton Standard System is a holistic approach to sustainable cotton production which covers all three pillars of sustainability: environmental, social and economic.

Each of the elements – from the Principles and Criteria to the monitoring mechanisms which show results and impact – work together to support the Better Cotton Standard System, and the credibility of Better Cotton and BCI. The system is designed to ensure the exchange of good practices, and to encourage the scaling up of collective action to establish Better Cotton as a sustainable mainstream commodity.

Defining ‘Better’: Our Standard

Providing a global definition of Better Cotton through 6 key principles and 2 cross-cutting priorities.

Training Farmers: Capacity Building

Supporting and training farmers in growing Better Cotton, through working with experienced partners at field level.

Demonstrating Compliance: Assurance Programme

Regular farm assessment and measurement of results through 8 consistent results indicators, encouraging farmers to continuously improve.

Connecting Supply & Demand: Chain of Custody

Connecting supply and demand in the Better Cotton supply chain.

Supporting Credible Communications: Claims Framework

Spreading the word about Better Cotton by communicating powerful data, information and stories from the field.

Measuring Results & Impact: Monitoring, Evaluation & Learning

Monitoring and evaluation mechanisms to measure progress to ensure that Better Cotton delivers the intended impact.